net investment income tax brackets 2021

2021 tax brackets are provided for those filing taxes in April 2022 or in October 2022 with an extension. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Calculating NIIT is not just as simple as multiplying your net investment earnings by 38.

. Federal income tax brackets. Your bracket depends on your taxable income and filing status. The adjusted gross income.

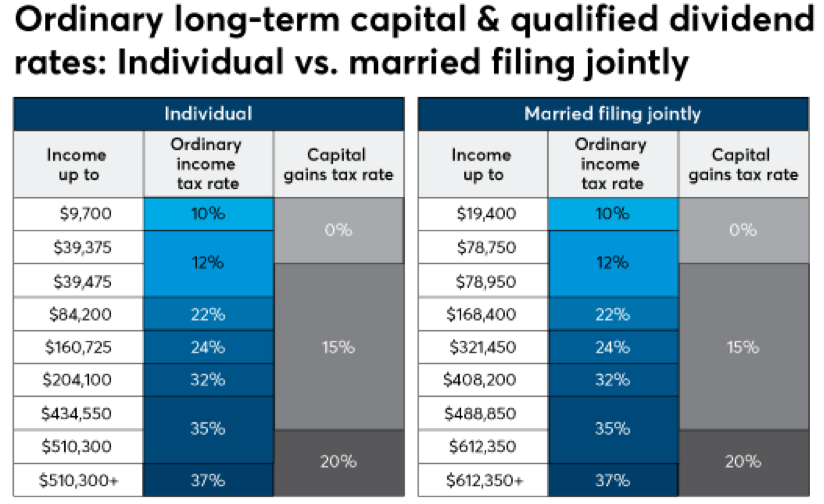

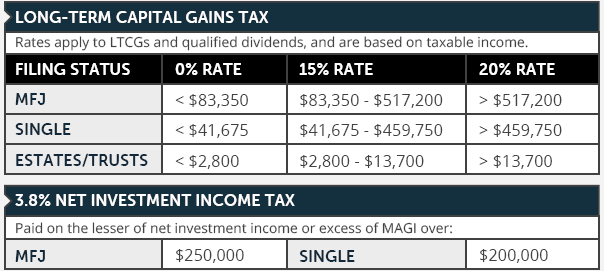

The IRS gives you a pass. Single taxpayers with taxable income of 41675 or less in 2022 qualify for a 0 tax rate on qualified dividends and capital gains. A Married Filing Jointly household has 300000 in income from self-employment and.

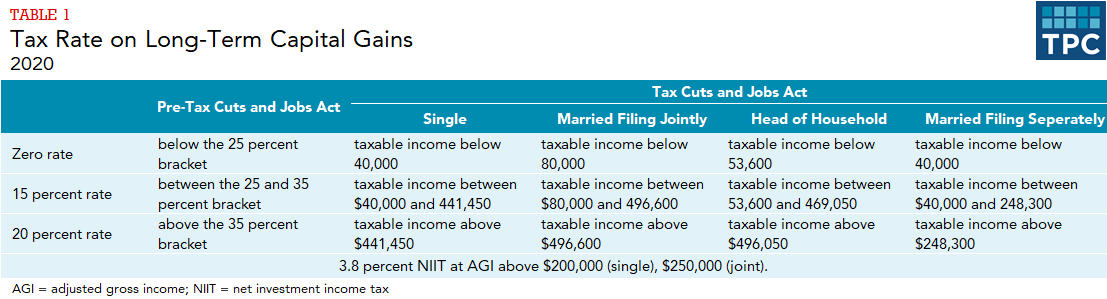

The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the. These are the rates for taxes due. In addition to these rates a 38 net investment income tax is assessed on the capital gains of high earners.

83350 for married couples filing jointly. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. B the excess if any of.

If you dont pay the full amount due by the regular due date the child will owe interest and may. In the case of an estate or trust the NIIT is 38 percent on the lesser of. The amount by which your.

41675 for married couples filing separately. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers. Here are the 2021 US.

A the undistributed net investment income or. The net investment income tax an additional 38. Here are the 2021 and 2022 federal income tax brackets.

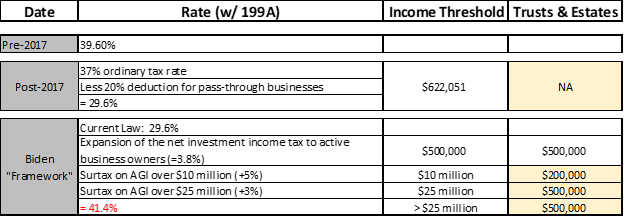

April 28 2021 The 38 Net Investment Income Tax. Their net investment income or the amount by which. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Many investors selling real estate or other high value investments are often surprised to find out that their tax liability could be subject to an extra 38 Surtax in addition to the applicable short. 2021 Federal Income Tax Brackets. There are seven federal tax brackets for the 2021 tax year.

NIIT is a tax on net investment income. Stay in a low tax bracket. Tax rate Single Married filing jointly Married filing separately Head of household.

Your capital gains rate is 0 for the 2022 tax year provided your income does not exceed. 10 12 22 24 32 35 and 37. Those who are subject to the tax will pay 38 percent on the lesser of the following.

The investment income above the 250000 NIIT threshold is taxed at 38. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. Net investment income tax NIIT.

You are charged 38 of the lesser of net investment. You must make an accurate estimate of the tax for 2021.

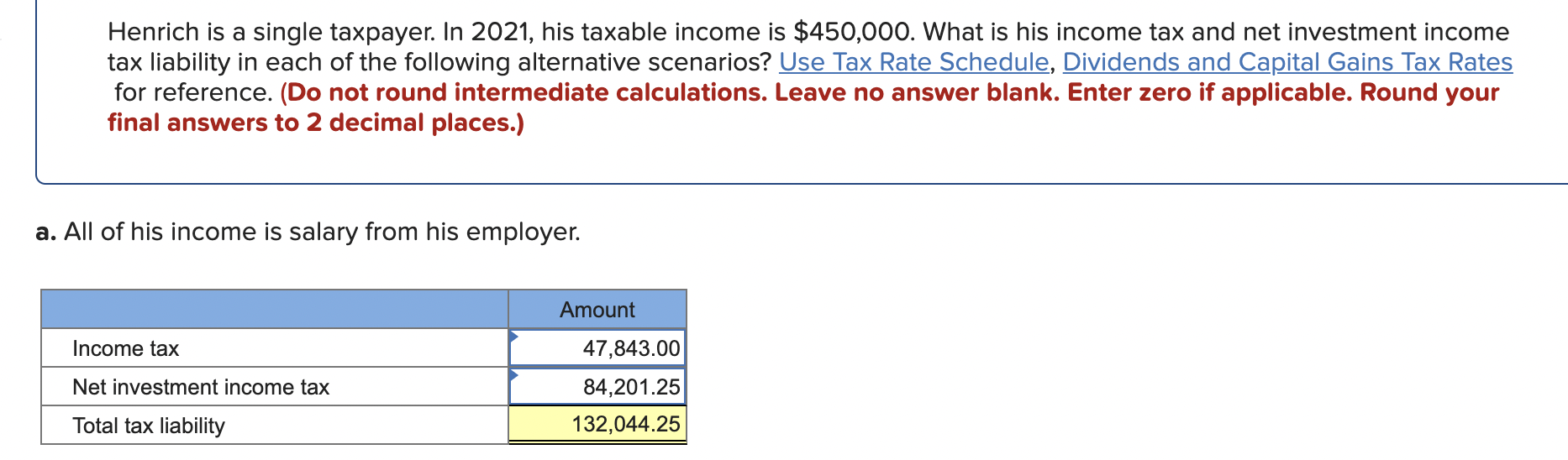

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Consider Taxes In Your Investment Strategy Rodgers Associates

Helpful Information For Filing 2020 Income Taxes And Proactive Tax Planning For 2021 Capital Income Advisors

Understanding The New Kiddie Tax Journal Of Accountancy

2022 Capital Gains Tax Rates By State Smartasset

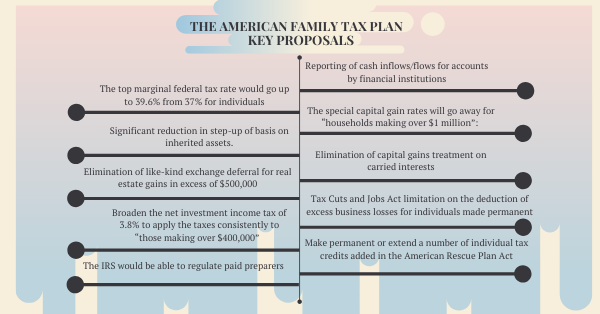

The American Family Tax Plan Nstp

Investment Expenses What S Tax Deductible Charles Schwab

Solutions For Problems Done In Class On 3 10 53 Lo 1 Is A Single Taxpayer In 2015 His Taxable Income Is 425 000 What Is His Tax Liability Course Hero

How Is The Net Investment Income Tax Niit Calculated

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

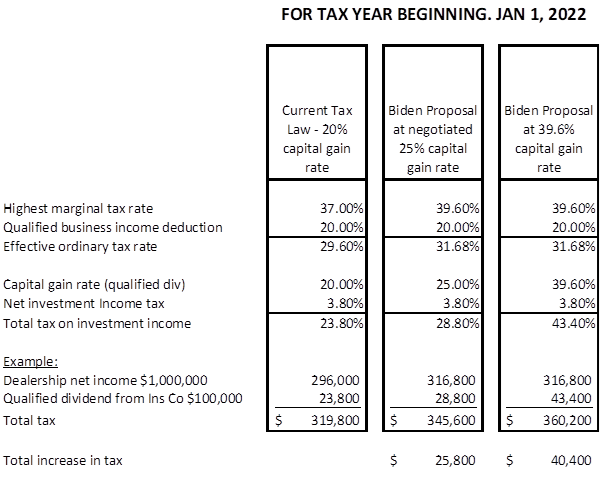

Assault On Family Businesses Continues The S Corporation Association

Capital Gains Archives Albion Financial Group

How Much Tax Do You Pay When You Sell A Rental Property

Capital Gains Tax In The United States Wikipedia

Build A Tax Efficient Taxable Account As A Physician Wealthkeel

How Are Capital Gains Taxed Tax Policy Center

Net Investment Income Tax When Does It Apply Calculating The Impact And How To Avoid Youtube

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)